Sustainable Future

Who We Are

We exist to foster transparency, comparability, and ESG readiness by delivering impartial, data-driven ratings aligned with international standards and regional contexts.

At A Glance

- Independent ESG ratings agency

- Regional focus: MENA capital markets

- Coverage: listed companies, financial institutions, strategic entities

Why Local ESG Ratings Matter for MENA?

Global ESG benchmarks often overlook regional regulatory, cultural, and socio-economic realities.

WADI Rating brings a Middle Eastern perspective to ESG evaluation by integrating national visions (such as Vision 2030 and Oman 2040) with global frameworks.

It ensures that our ratings are relevant, trusted, and actionable for regulators, investors, and listed companies in the region.

- Dive into policy trackers, sectoral insights, and country-level benchmarks that support informed ESG strategies and regulatory alignment.

From Sustainability Reports to ESG Scores

WADI Rating is an independent ESG ratings agency assessing environmental, social, and governance performance across the Middle East and North Africa.

We exist to foster transparency, comparability, and ESG readiness by delivering impartial, data-driven ratings aligned with international standards and regional contexts.

5-Step Workflow

- Collect disclosures

- Read & extract ESG KPIs

- Build evidence tables

- Score & weight indicators

- Expert review & final rating

Featured Projects

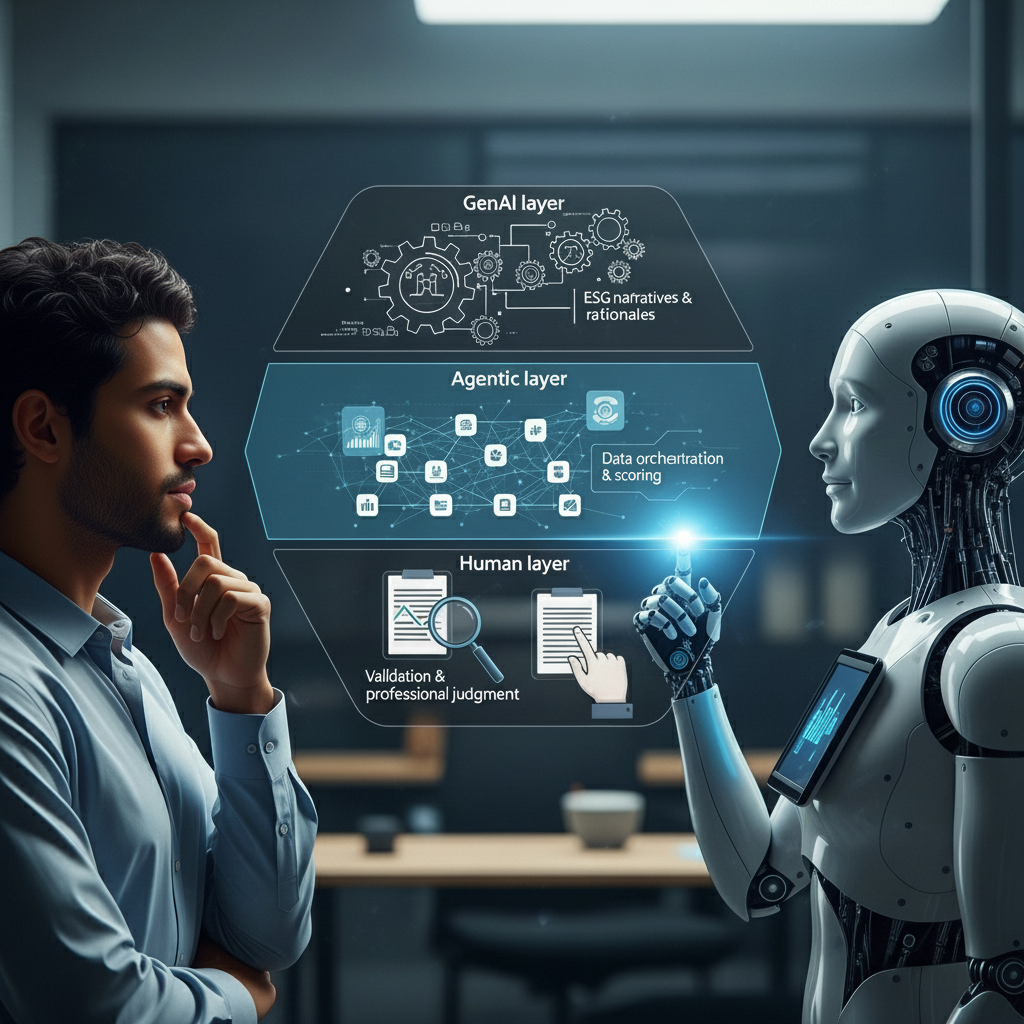

Agentic AI-Powered, Human-Reviewed ESG Ratings

WADI Rating combines Generative AI and Agentic AI to accelerate and deepen ESG analysis:

- Generative AI drafts narratives and peer comparisons,

- While Agentic AI orchestrates data collection, scoring logic, and quality checks.

Every rating remains human-in-the-loop.

Our analysts validate evidence, interpret nuance, and ensure ethical, context-aware judgment.

- GenAI layer – ESG narratives & rationales

- Agentic layer – data orchestration & scoring

- Human layer – validation & professional judgment

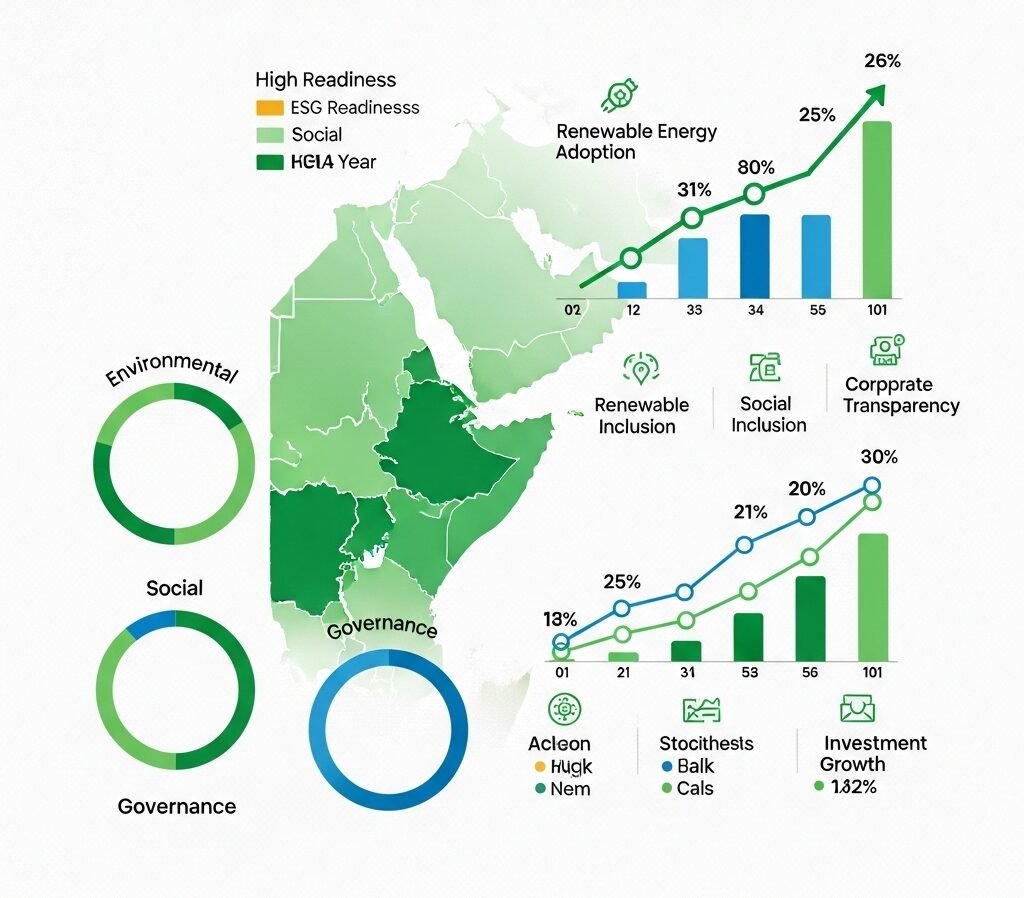

MENA ESG Readiness Index

Tracking ESG Maturity and Progress Across MENA Markets

The MENA ESG Readiness Index is WADI Rating’s research-based public good, offering a comparative view of ESG maturity across listed companies and markets in the region. It enables exchanges, regulators, and investors to track regional progress and identify leaders and laggards over time.

Latest Research & Insights

Together, We Can Build a More Transparent and Sustainable MENA

Fueling Accountability and Sustainable Growth

Who Engages with WADI Rating?

Stock Exchanges & Regulators

Market-wide ESG visibility

Investors & Funds

Independent input for risk and opportunity analysis

Listed Companies & Financial Institutions

Benchmarked ESG maturity and disclosure quality

Universities & Policy Institutions

Data and insights for research and policy work

Let’s Build ESG Confidence Together

What They Are Saying

Driving ESG Excellence in MENA

The MENA ESG Readiness Index is WADI Rating’s research-based public good, offering a comparative view of ESG maturity across listed companies and markets in the region. It enables exchanges, regulators, and investors to track regional progress and identify leaders and laggards over time.

WADI Rating’s mission is to equip the MENA region with the ESG intelligence, benchmarks, and integrity standards needed to support a fair, transparent, and accountable transition toward sustainable growth.

We exist to measure ESG maturity, illuminate progress, and guide collective action across public and private sectors — through regionally adapted indices, ratings, and open-access research.

By fostering trusted partnerships and upholding the highest standards of independence, we enable governments, investors, and enterprises to make confident decisions in a rapidly evolving sustainability landscape.

To become the region’s trusted ESG Rating reference — empowering MENA’s sustainable transformation with transparency, data-driven insight, and regional leadership.

At WADI Rating, our work is rooted in:

- Independence — We do not offer commercial consulting, implementation, or technology services. Our assessments are free from bias or influence.

- Integrity — We operate with a strict Ratings Integrity Protocol, governed by a transparent oversight structure.

- Regional Relevance — Our methodology integrates global ESG frameworks with the socioeconomic, cultural, and policy realities of the Middle East and North Africa.

Founding Principles

- ESG Ratings Division operates independently

- Oversight committee ensures process integrity

- No commercial or advisory conflict of interest

- Methodologies align with evolving global standards

- Research serves public good and market transparency